Why Having A Fixed Assets Process Is Important

Business is running smoothly, no issues seem to be arising, but what you don’t know is that there are potential underlying factors that can severely impact your bottom line. In this article we will explore why having a Fixed Assets solution in place is import and how not having one can truly impact your bottom line.

Business is running smoothly, no issues seem to be arising, but what you don’t know is that there are potential underlying factors that can severely impact your bottom line. In this article we will explore why having a Fixed Assets solution in place is import and how not having one can truly impact your bottom line.

So first, let’s answer the burning question… WHY?

- Data Integrity

- Preventing Fraud

- Audit Preparation

- “Ghost” & “Zombie Assets

- Disaster Recovery

- Compliance

- Savings

Well let’s be honest, spreadsheets have long been a popular starting point for handling most necessary fixed assets records. However, as businesses grow, and tax laws become more complex, it becomes clear that spreadsheets are no longer a good solution. Keeping spreadsheets up to date can start as a simple process but can quickly grow into a time-consuming burden as they do not scale well with growing businesses.

Well let’s be honest, spreadsheets have long been a popular starting point for handling most necessary fixed assets records. However, as businesses grow, and tax laws become more complex, it becomes clear that spreadsheets are no longer a good solution. Keeping spreadsheets up to date can start as a simple process but can quickly grow into a time-consuming burden as they do not scale well with growing businesses.

As your business expands, spreadsheets become more complex, using various formulas and cell dependencies so you can work with your data. Spreadsheets offer minimal security and access control options, opening the door to dirty data due to lack of control.

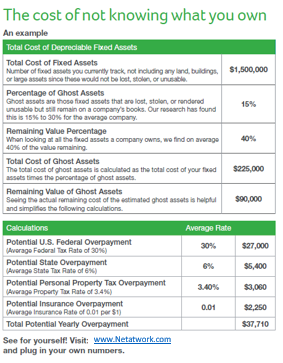

This matters for several reasons. Bad data means bad reports, if you do not have an accurate asset count and value, you may be over paying on taxes or property insurance. Further, if you have bad asset counts, you may find that you don’t have a business-critical asset on hand when it is needed. Also, when the auditors come knocking the state of your data can determine success or a long drawn out unsuccessful audit.

You might be thinking how does this apply to me?

Whether you’re reporting to senior management, a government agency, auditors, donors/executive boards, or the IRS, you’re accountable for the status and value of your organization’s fixed assets. Those assets can take the form of buildings, machinery, computers/other electronic equipment, office furnishings, even assets you build. Accurately tracking their varied lifecycles can be a daunting task to manage manually which in the end can mean the difference between major penalties or major cost savings.

Whether you’re reporting to senior management, a government agency, auditors, donors/executive boards, or the IRS, you’re accountable for the status and value of your organization’s fixed assets. Those assets can take the form of buildings, machinery, computers/other electronic equipment, office furnishings, even assets you build. Accurately tracking their varied lifecycles can be a daunting task to manage manually which in the end can mean the difference between major penalties or major cost savings.

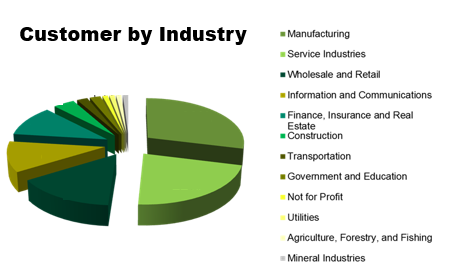

Bottom line, all organizations no matter their size or industry can benefit from having a solid solution in place with current up to date tax laws, accurate reports, and one secure location to store data. Learning ways to manage your Fixed Assets from within and creating easy to follow policies and procedures will save you time and money towards your bottom line.