Acumatica 1099 Processing for Calendar Year 2020

Acumatica 1099 Processing for Calendar Year 2020

Beginning with tax year 2020, businesses will now need to use Form 1099-NEC to report non-employee compensation in Acumatica Cloud ERP. Form 1099-MISC has been updated with rearranged box numbers for reporting certain income.

1099 MISC / 1099 NEC in Acumatica

- Starting in 2020, form 1099-MISC was redesigned to remove Non-Employee compensation, and a new Box 7 was added.

- For those that issue Non-Employee 1099s, reporting will now be done using form 1099-NEC.

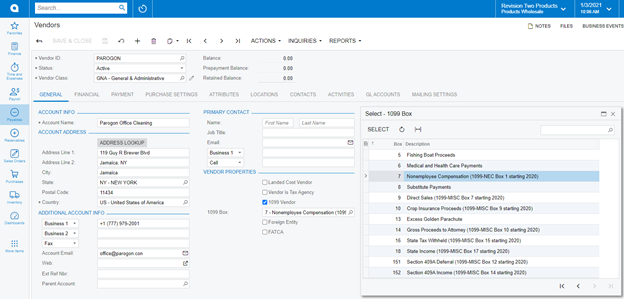

Acumatica Vendor Setup

- In Acumatica versions 2019 R2 or later, no Vendor setup changes are needed.

- Acumatica will automatically print nonemployee compensation amounts, which were historically in 1099-MISC Box 7, now as form 1099-NEC Box 1.

- Other 1099 settings will also automatically print to the proper 1099-MISC boxes:

- Box 9 Direct Sales will print to 1099-MISC Box 7

- Box 10 Crop Insurance Proceeds will print to 1099-MISC Box 9

- Box 14 Gross Proceeds to Attorney will print to 1099-MISC Box 10

- Box 16 State Tax Withheld will print to 1099-MISC Box 15

- Box 18 State Income will print to 1099-MISC Box 17

- Box 151 Section 409A Deferral will print to 1099-MISC Box 12

- Box 151 Section 409A Income will print to 1099-MISC Box 14

- Please contact Net at Work to discuss version upgrades or 1099 reporting workaround processes with Acumatica versions 2019R1 and lower.

- NOTE – Acumatica does not process 1099 Interest or 1099 Dividends

Where to purchase 1099 Forms

- Pre-printed 1099-NEC or 1099-MISC Forms can be purchased online through Amazon.com, or in stores like Costco, Walmart or Office Depot.

- Do not wait until the end of January process your 1099s!!!

- Employers must file forms 1099-MISC and 1099-NEC by February 1, 2021.

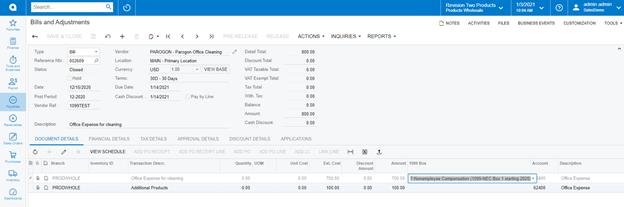

Updating YTD 1099 Amounts in Acumatica

- If AP Invoices have been processed for the year but not marked correctly for 1099 purposes:

- Update the original transactions using AP Bills and Adjustments, changes to the 1099 Box settings in Document Details are allowed even after the AP Bill has been Released.

- Update the original transactions using AP Bills and Adjustments, changes to the 1099 Box settings in Document Details are allowed even after the AP Bill has been Released.

- For system conversion purposes or to enter a summary 1099 amount for a Vendor:

- Enter an AP Quick Check, using the same GL Account as both the DR and CR to create a wash entry in the General Ledger.

- The amount of the Quick Check can be used as a summary entry for the 1099 vendor.

- The Quick Check will need to be cleared in Banking for reconciliation purposes.

Reviewing 1099 Details in Reporting in Acumatica

- Run the 1099 Year Details report to see your 1099 Amounts.

- NOTE – Compare this to your AP Payment Register report to make sure you did not miss any payments not marked as a 1099.

Printing 1099-NEC Forms Acumatica

- Under the 1099 Menu, run the 1099-NEC Form for each Company/Branch.

- NOTE – Get your 1099-NEC forms ordered ahead of time.

- NOTE – Test two vendors before printing 1099 forms for all vendors.

Filing the 1099-NEC Electronically in Acumatica

- Under the 1099 Menu, you can run the 1099-NEC Create E-File Process.

- This will create a text file that you then transmit to the IRS.

- NOTE – This process in Acumatica will create the file, but It will not transmit it for you!

Closing the 1099 Year in Acumatica

- Once you have printed and submitted your 1099s, close your 1099 Year.

- This locks your 1099 amounts and prevents your numbers from changing.

Please contact Net at Work with any questions or to schedule a quick review of the Acumatica 1099 reporting process.