How to Create a Fixed Asset Group Association in Sage X3

How to Create a Fixed Asset Group Association in Sage X3

A feature of fixed assets that is not used often is the Fixed Asset Group. Setting up and managing fixed assets by group will ease data entry and provide more granular financial tracking by asset type. Read this blog post to learn how to configure fixed asset groups and assign them to your fixed assets.

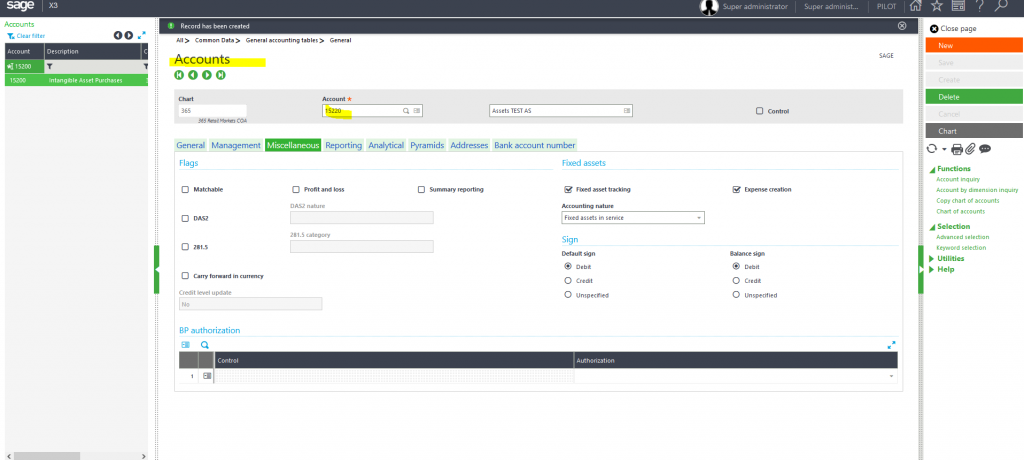

STEP 1

Create a new GL account for Fixed Assets, mark the checkboxes ‘Fixed Assets Tracking’ and ‘Expense Creation’.

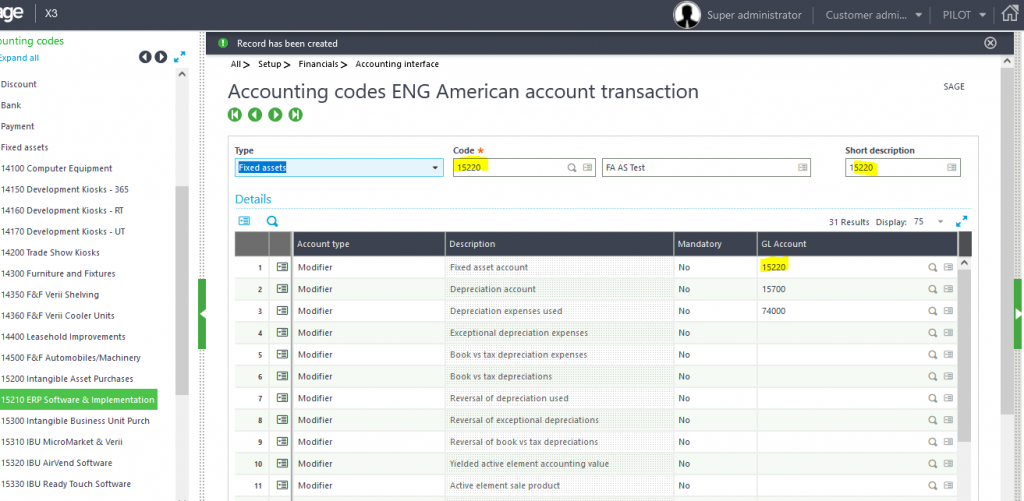

STEP 2

Create the FA Accounting code accordingly. It is not necessary to give these new codes names similar to the GL account’s name, but it helps.

To use these FA Group Accounting Codes, X3 FA must have a ‘FA Group’ associated. This is what we’ll do in the next step.

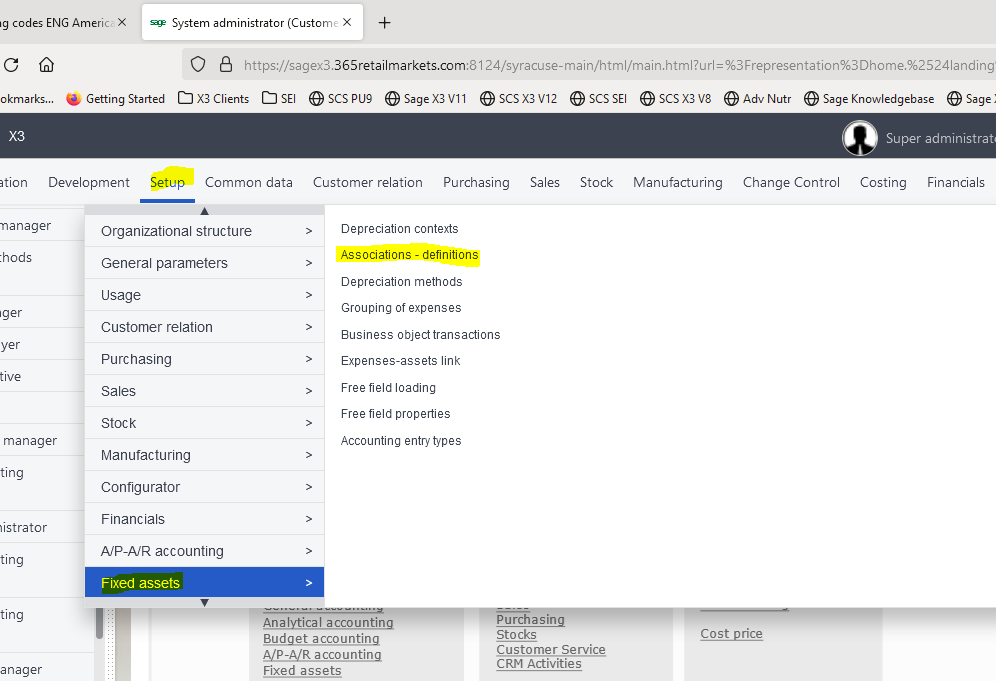

STEP 3

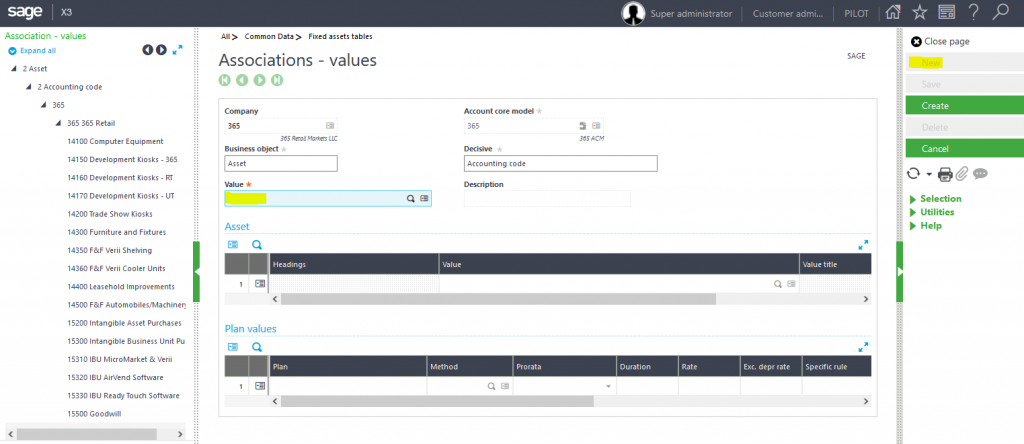

Go to Setup > Fixed assets > Associations.

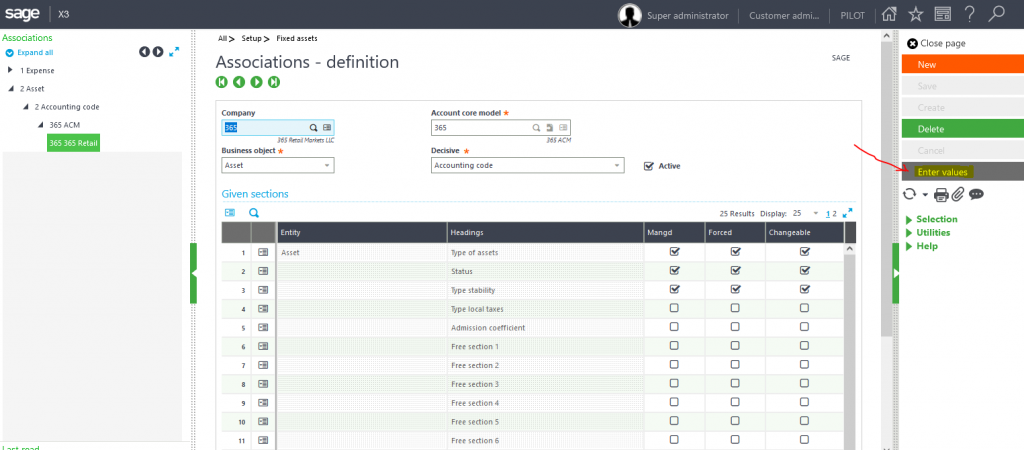

There are two main groups in these associations—Assets or Expenses. We’ll use Assets. Then click on Enter Values:

STEP 4

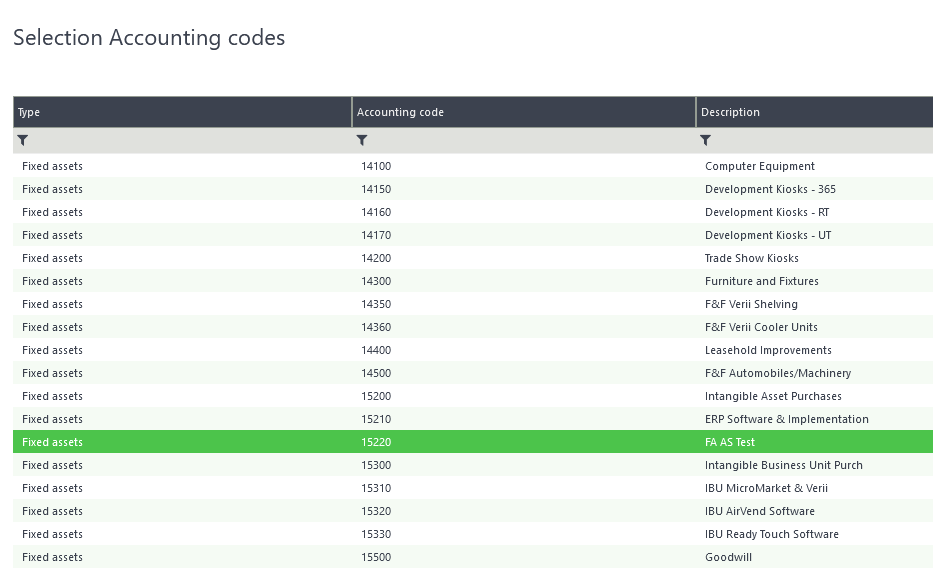

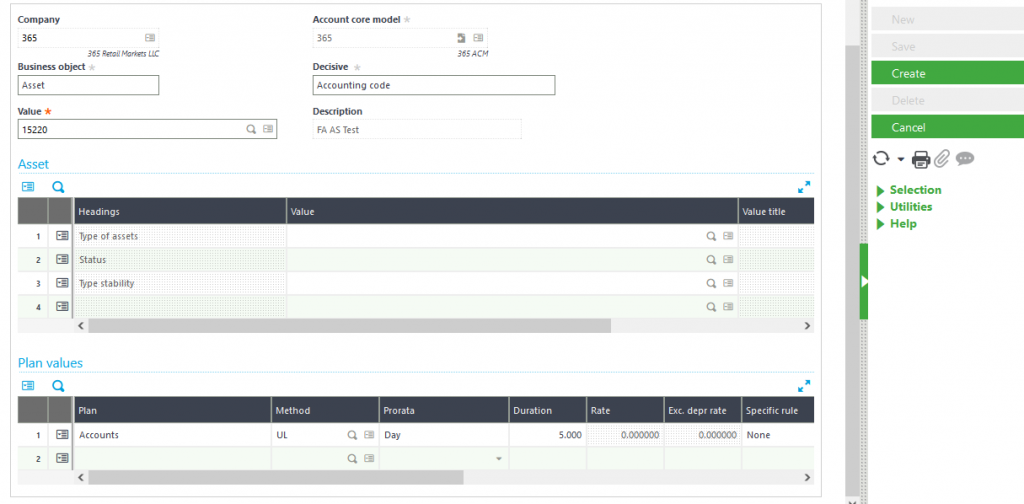

Here we’ll create the Value 15220. Click on ‘New’:

In the Value field, enter the 15220 Acc Code just created, or look it up from the list with the magnifying glass:

STEP 5

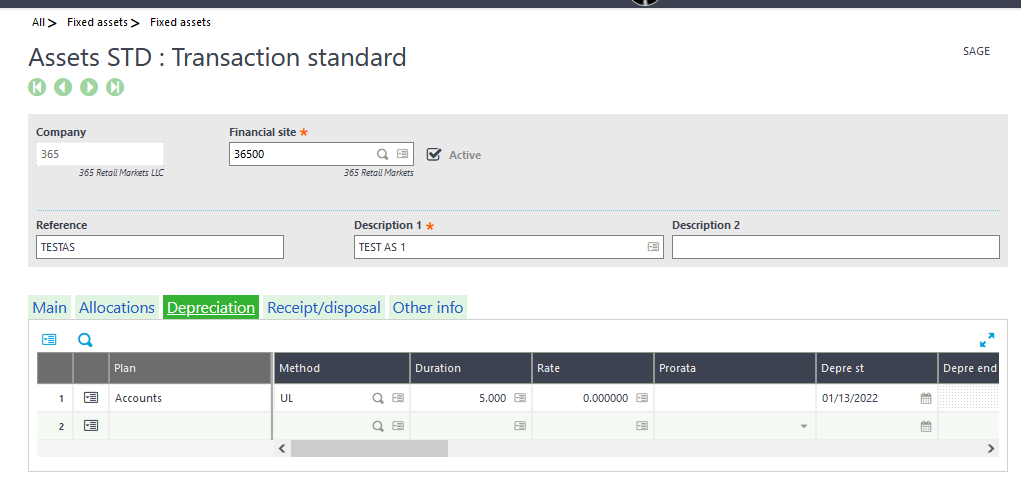

The next step is to choose the depreciation method, along with the duration in years.

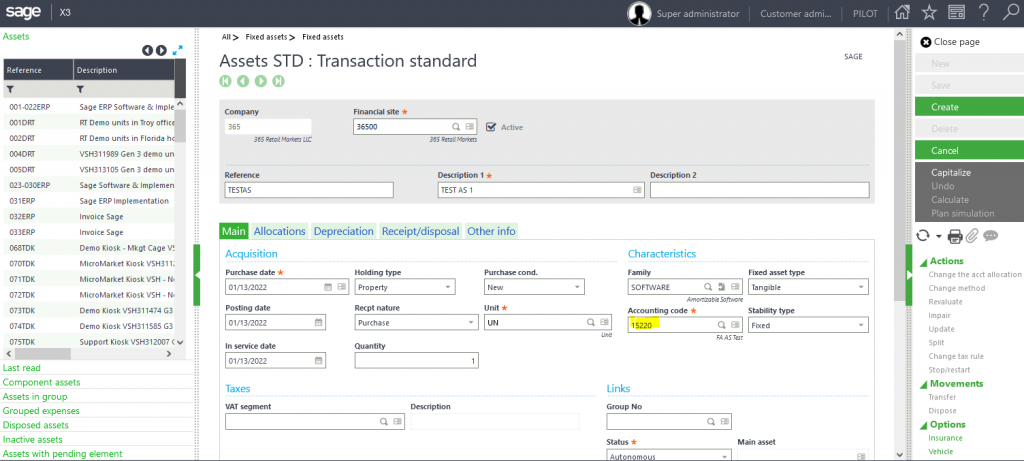

After that, you’ll be all set to create a new asset or to capitalize an expense going to this asset group, which in turn is associated with the 15220 account:

For more information on creating a Fixed Asset Group Association in Sage X3, please contact us.