How to Manage Withholding Tax in Sage X3

How to Manage Withholding Tax in Sage X3

A withholding tax, also known as a retention tax, is a required tax paid directly to a tax authority by the buyer of goods or services. Withholding tax is typically calculated as a percentage of the amount of the sale.

Configuration

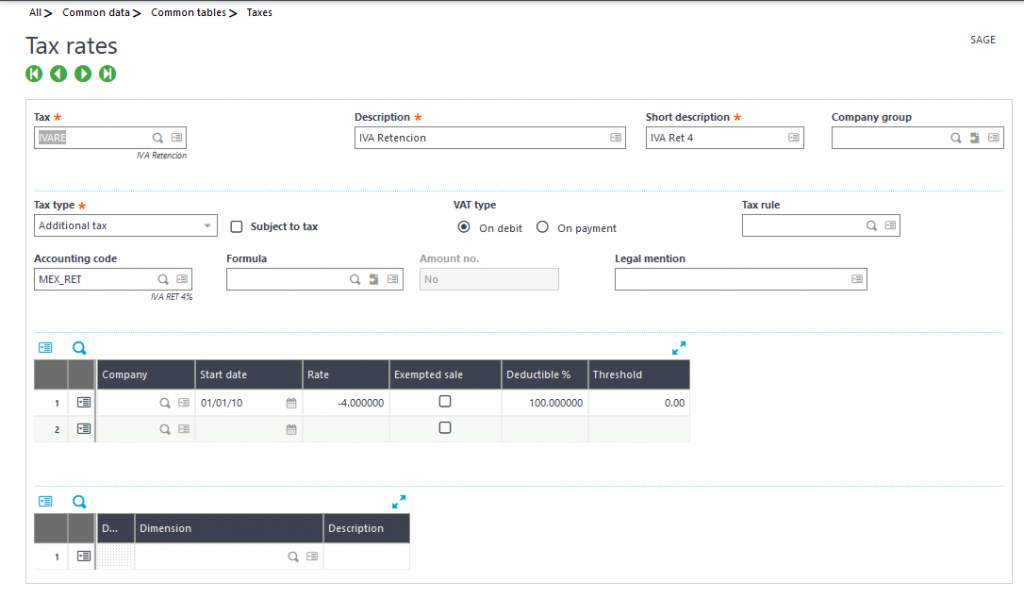

In Sage X3, a withholding tax is defined by creating a negative tax. The first step is to configure the Tax Rate. The Tax Rate creates the logic and the given percentage (%) for the Retention:

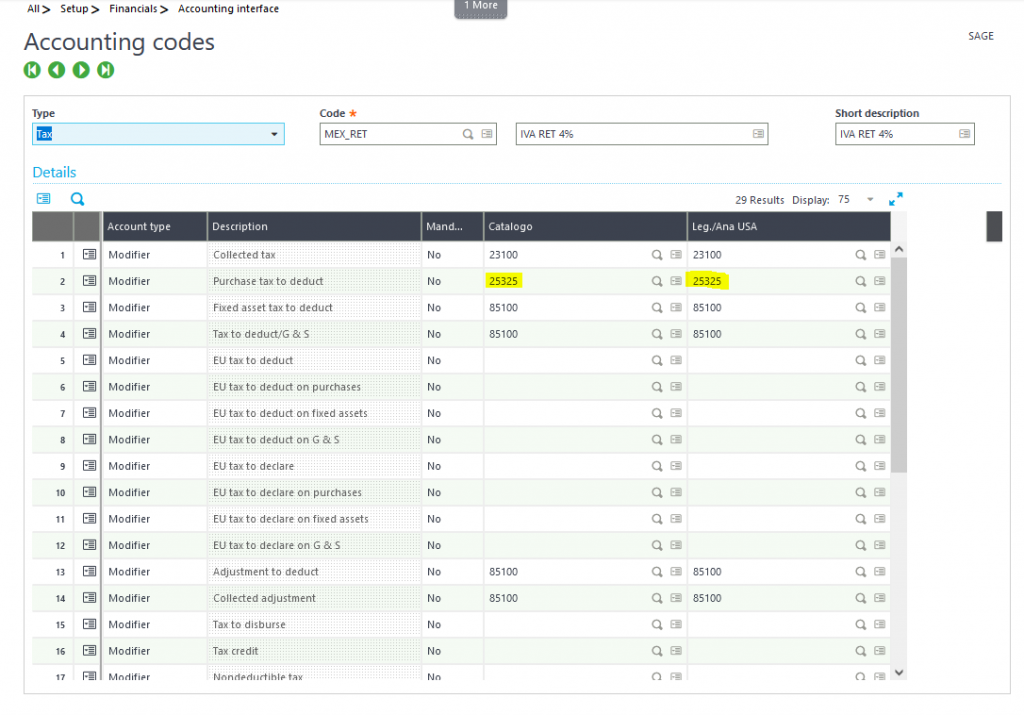

You will also need to create a new Tax Accounting Code for this tax. Because it is a retention, it will be a liability:

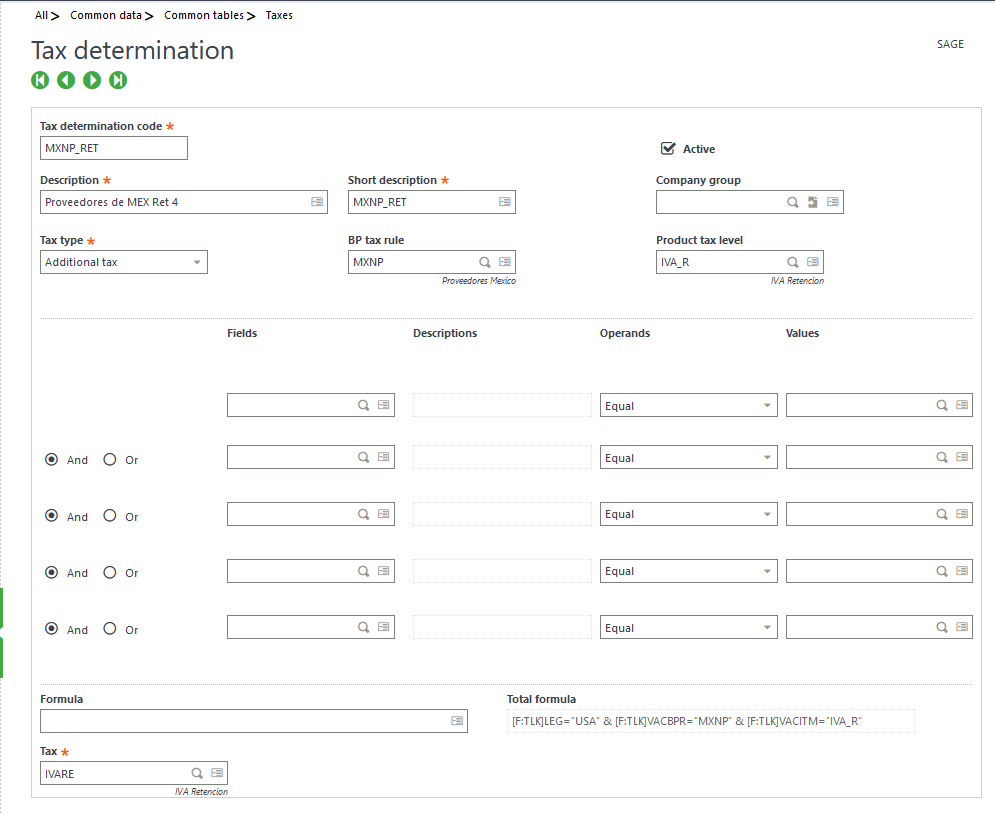

The next step is to create the Tax Determination. The Tax Determination will tie the logic of the tax calculation to its usage (will link the Tax to a BP Tax Rule and a Product Tax Level).

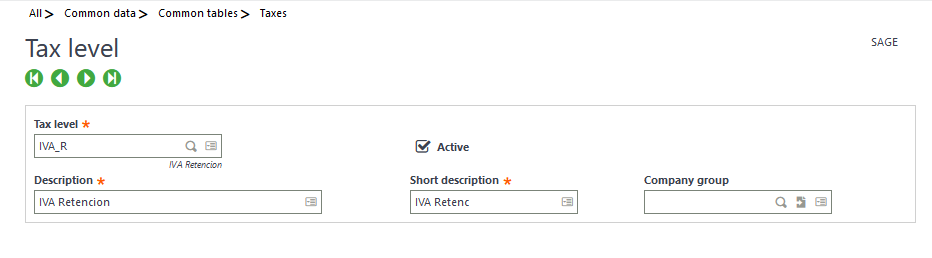

The next step is to create a Product Tax Level. This will be necessary for adding the Retention (Tax Withholding) to the products that will be subject to the retention.

With this configuration, you can use a product that is subject to the withholding (freights, for example) and a regular product (not subject to the retention) in the same invoice.

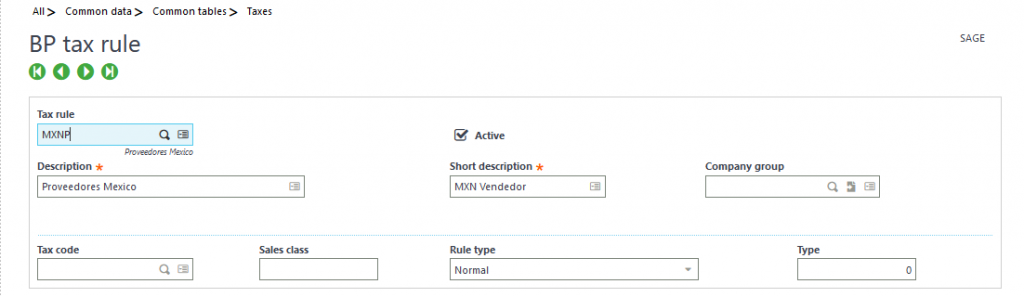

The BP Tax Rule does not need to be changed; we have already linked the Tax Determination to the BP Tax Rule.

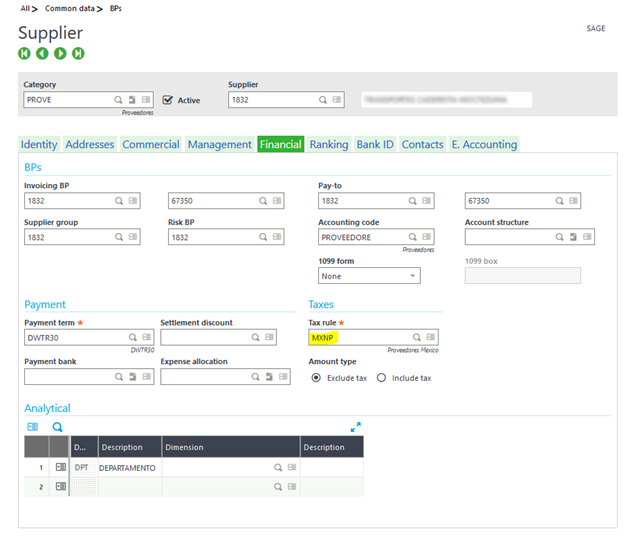

As discussed on the previous step, the BP Tax Rule does not need to be modified. What is important is to note that any supplier for which we need to perform Retentions will have to be configured with the BP Tax Rule used in the Tax Determination:

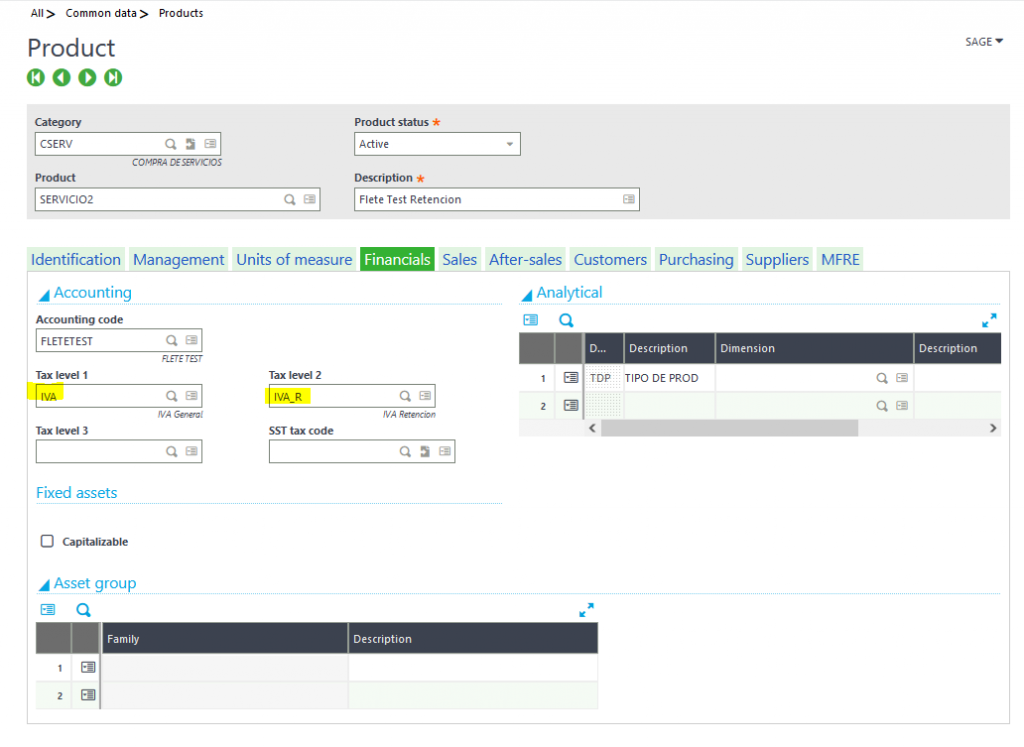

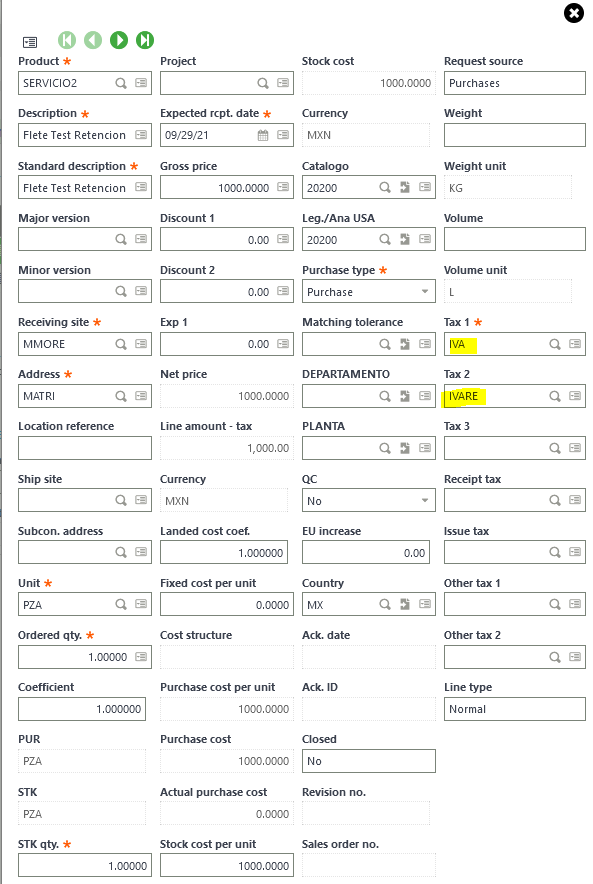

Here is the key change…the Product subject to the withholding will have to include the Retention Tax Level as ‘Tax Level 2’, so both tax codes will be used in the invoice for this product / supplier:

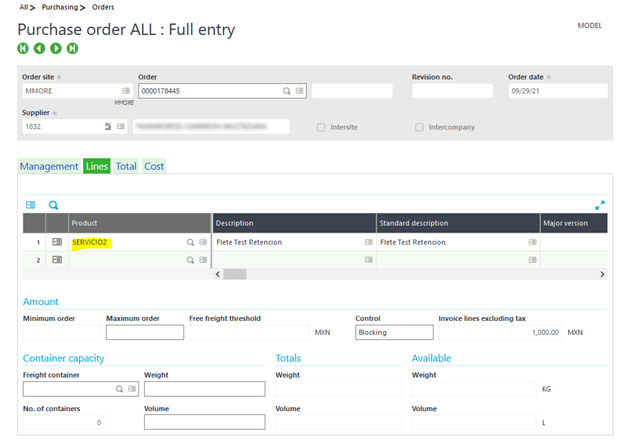

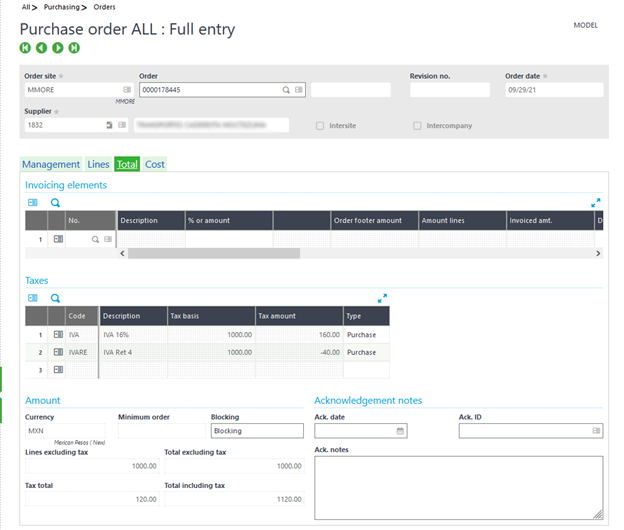

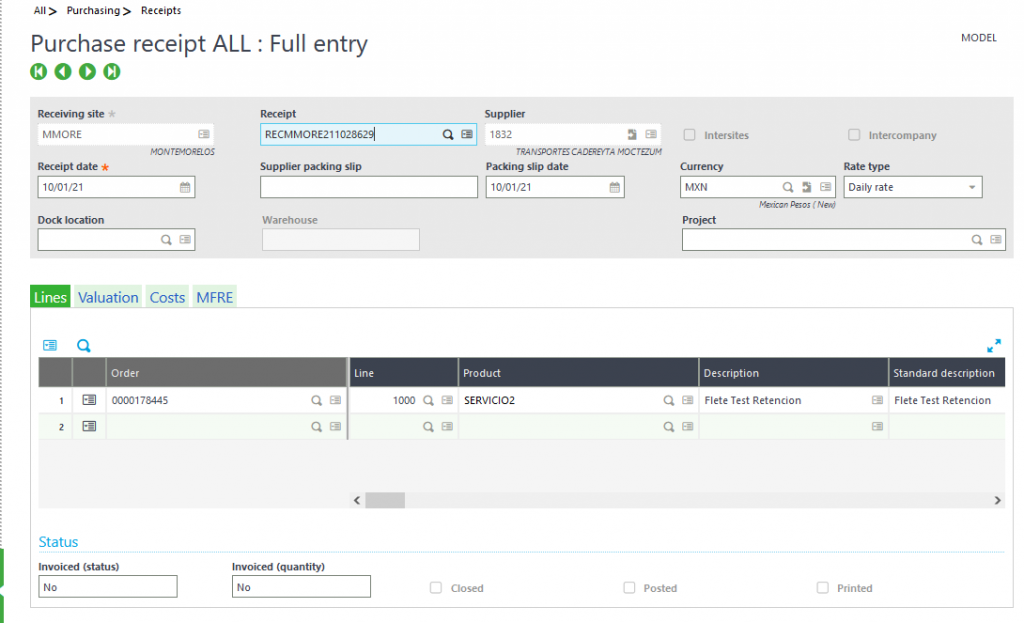

Below you can see what Sage X3 automatically adds when you create a new Purchase Order. Both Tax Codes are present and working together. Please note the negative amount calculated by the Retention 4% tax code:

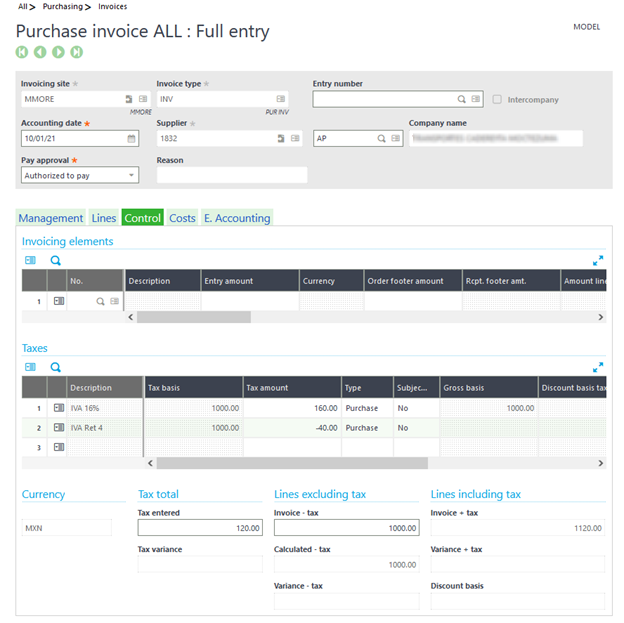

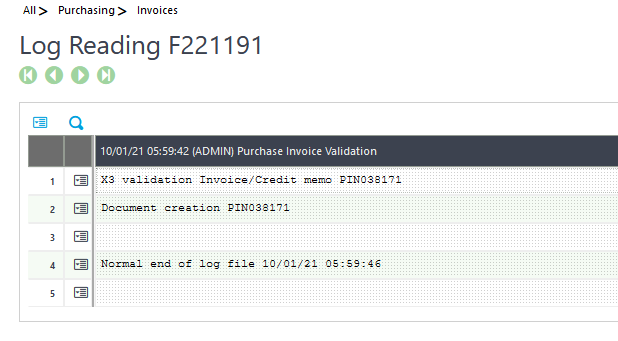

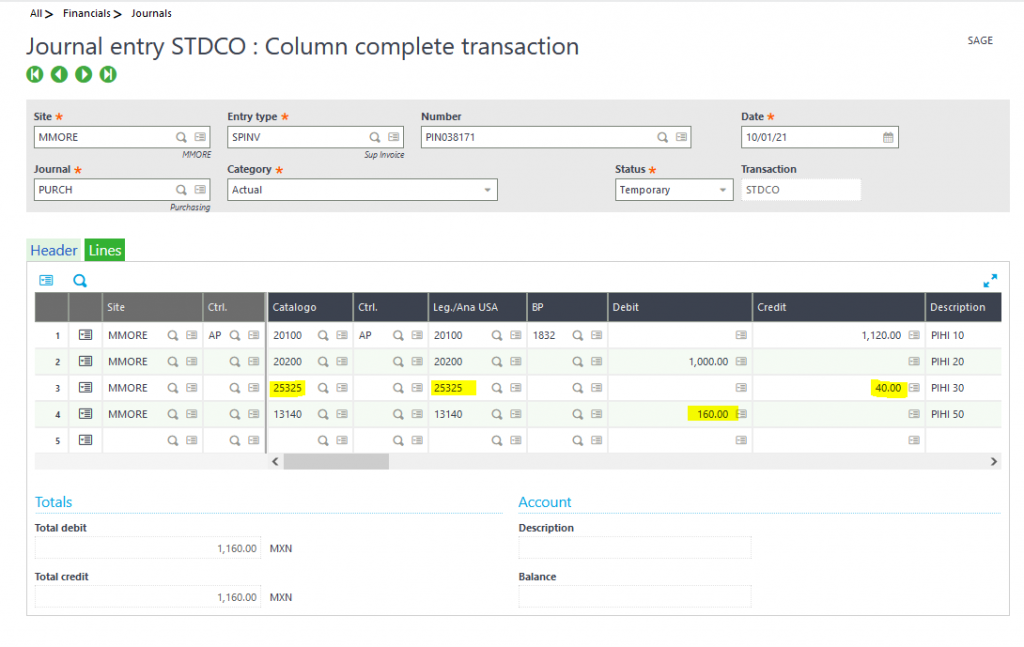

After the posting, you will see the correct amounts for the correct accounts reflected when you view the Journal Entry:

For more information on managing withholding tax in Sage X3, or for any other Sage X3 questions, please contact us.