Employer Solutions / HRMS Newsletter – September 2016

Keeping You Up-To-Date With Information About Employer Solutions / HRMS

Affordable Care Act Changes for 2016

As employers approach the second year of mandated Affordable Care Act (ACA) reporting, it is important to recognize that the rules and responsibilities are changing.

As employers approach the second year of mandated Affordable Care Act (ACA) reporting, it is important to recognize that the rules and responsibilities are changing.

IRC Code Section 6056 under the Affordable Care Act (ACA) requires applicable large employers (ALEs) to report to the IRS whether they offer their full-time employees and their employees’ qualified dependents the opportunity to enroll in minimum essential coverage (MEC) under an eligible employer-sponsored plan.

An ALE is an employer that employed (any combination of workers within a controlled group) an average of at least 50 full-time employees (including full-time equivalent employees) during the preceding calendar year. Employees are considered full-time for any month in which they are credited with at least 30 hours of service per week, on average, or 130 hours of service in the month. Beginning in 2016, there are number of changes to be aware of.

Changes to the employer mandate

There have been several changes in cover requirements, affordability requirements, employer mandate penalty changes, and more. Here are some:

- 2015 coverage requirements: Businesses with 100 or more full time employees or full-time equivalents had to offer at least 70% of full time employees insurance to avoid penalties.

- 2016 changes to coverage requirements: Businesses with at least 50 full time employees or full-time equivalents must offer at least 95% of full time employees insurance to avoid penalties.

Changes to the definition of “affordability” requirements

Under section 4980H, a plan must also be affordable. Coverage is considered “affordable” for IRC Sec. 4980H purposes if the cost to the employee of self-only coverage does not exceed a specified percentage of the employee’s “household income.”

This is true irrespective of whether he or she qualifies for some other level of coverage (e.g., self plus dependents, family). Thus, although family coverage might require a larger employee premium, affordability for IRC Sec. 4980H purposes is determined based on the cost of self-only coverage. The Act defines “household income” to mean “modified adjusted gross income of the employee and any members of the employee’s family (including a spouse and dependents) who are required to file an income tax return.”

- 2015 affordability requirements: The plan is affordable if the self-only coverage health care plan costs no more than 9.5% of an employee’s total household income.

- 2016 affordability requirements: The threshold of affordability for the plan has been raised to 9.66% of the employee’s total household income.

In addition to actually calculating the numbers for each employee, the ACA offers the use of three “safe harbors” as proxies for defining affordability: Form W-2 wages, an employee’s rate-of-pay, or use of the Federal Poverty Line.

Employer mandate penalty changes

Employers can be penalized for not providing minimum essential coverage or for having an inadequate health plan. Employers that offer health coverage will not meet the requirements if the following occurs:

- at least one full-time employee obtains a premium credit in an exchange plan, and

- the plan does not provide minimum essential benefits; the employee’s required contribution for self-only coverage exceeds the specified percent of the employee’s household income; the employer pays for less than 60 percent of the benefits.

Neither penalty is triggered unless an employee receives a tax credit for the purchase of health insurance on a state exchange. (Look for a future Employer Solutions Newsletter article on responding to employees seeking or obtaining premium credits.)

Form 1094/1095 Due Dates

In 2016, the IRS extended the due dates for reporting the 2015 1094\1095 forms until March 31st for printed copies to employees and June 30th for electronic submission. More than 40% of employers took advantage of that extension. However, the IRS has stated all forms – printed and electronic – will be due on January 31st, 2017.

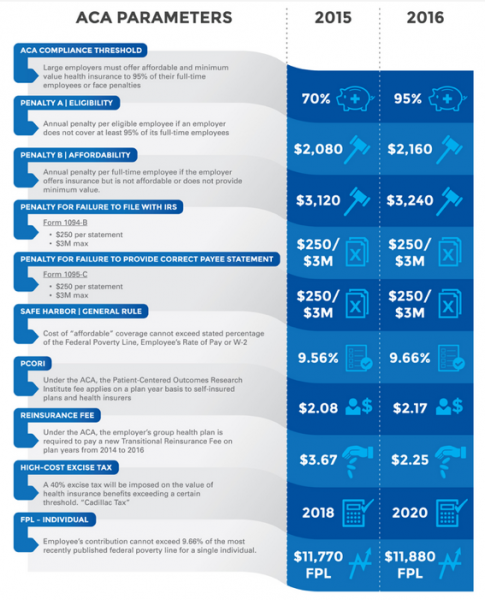

The graphic below outlines these and some of the other changes to ACA reporting for 2016.

Source: https://www.benefitfocus.com/blogs/benefitfocus/affordable-care-act-changes-for-2016

Form changes

On July 7, 2016, the Internal Revenue Service (IRS) issued drafts of 2016 Forms 1094-C and 1095-C. Although Forms 1094-C and 1095-C are largely unchanged from prior versions, they included some noteworthy clarifications and revisions.

To review, the ACA information on Form 1095-C is arranged in three rows of coded information, by month, for each full-time employee.

- The first row (Line 14) on the form identifies whether the ALE offered minimum essential coverage (MEC) to the employee and any spouse and qualified dependents, and whether such coverage provided minimum value.

- The second row (Line 15) reports the employee’s share of the lowest-cost monthly premium for self-only minimum value coverage.

- The third row (Line 16) includes any information needed to determine whether the employer may be liable for a shared responsibility payment. For example, codes are entered to identify employees who were not employed or who were not full-time during a month, or who enrolled in coverage offered. Other codes identify transitional or “safe-harbor” relief (e.g., employees in limited, non-assessment periods, or coverage meeting affordability safe-harbor tests).

Noteworthy Changes to Forms

Form 1094-C

- Line 22, option B is now labeled as “Reserved” because the Qualifying Offer Method Transition Relief was only available for tax year 2015

Form 1095-C

- “Plan Start Month” in Part II will be optional again for tax year 2016 reporting

- Part III specifies that the employee should also be listed under covered individuals if the employee was enrolled in coverage (formerly this information was only in the instructions)

- Column (b) in Part III specifies that an SSN or other TIN is acceptable for covered individuals (formerly only in the instructions)

- Column (c) in Part III still allows for a date of birth for covered individuals, if the SSN/TIN is unavailable

- On page two (Instructions for Recipient), the line 14 description explains that coverage offered through a multiemployer/union plan may not be reflected, which suggests that multiemployer plan transition relief may still apply for tax year 2016 reporting

- Line 14 code 1I is now “Reserved.” It formerly related to Qualifying Offer Method Transition Relief for 2015

- Two additional line 14 codes related to conditional offers to spouses have been added. Additional details regarding when to use these codes are expected when form instructions are published.

- 1J: Minimum essential coverage providing minimum value offered to the employee; minimum essential coverage conditionally offered to spouse; and minimum essential coverage not offered to dependent(s)

- 1K: Minimum essential coverage providing minimum value offered to the employee; minimum essential coverage conditionally offered to spouse; and minimum essential coverage offered to dependent(s)

Draft Instructions for Forms 1094-C and 1095-C for tax year 2016 are expected to be published by the IRS in late summer or early fall. Draft copies of the forms 1094-C\1095-C can be seen here: https://www.irs.gov/pub/irs-dft/f1095c–dft.pdf and https://www.irs.gov/pub/irs-dft/f1094c–dft.pdf