Incentive for Technology Purchases Before Year End

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment (including software and hardware) purchased or financed during the tax year. This year, the amount you can immediately write off has gone up to $560,000 (from $500,000 in 2011). It’s an incentive created by the U.S. Government to encourage businesses to buy equipment and invest in themselves.

When your business buys equipment including computer hardware and software, you typically have to write it off a little at a time through depreciation over the life of that equipment. With Section 179 you can write it all off this year, even if you lease the purchase. It is meant to incentivize you to purchase equipment this year instead of waiting.

Section 179 at a Glance – New for 2012

2012 Deduction Limit = $139,000

This is good on new and used equipment, as well as off-the-shelf software.

2012 Limit on equipment purchases = $560,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced.

Bonus Depreciation = 50%

This is taken after the $560k limit in capital equipment purchases is reached. Note: Bonus Depreciation is available for new equipment only. Bonus Depreciation can also be taken by businesses that will have net operating losses in 2012.

The above is an overall, “simplified” view of the Section 179 Deduction for 2012. For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please visit http://www.section179.org

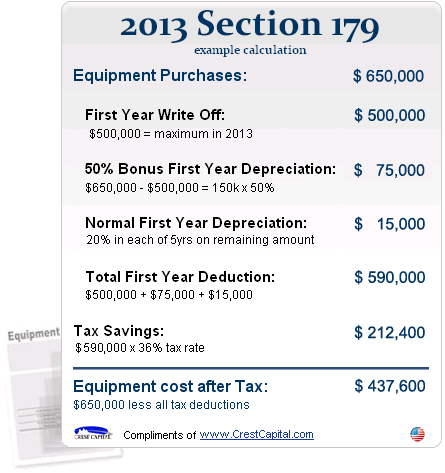

Here is an example of Section 179 at work:

If you’ve been thinking about adding equipment or software, but just haven’t been able to pull the trigger, contact us today to find out how easy we can make it for you to get the equipment you need and the write-off you deserve.