Tax Benefits for Technology Purchases Before Year-End 2013

Businesses have significant reasons to acquire and install capital equipment before the end of 2013, thanks to the American Taxpayer Relief Act of 2012, and Section 179 of the IRS tax code – which allows businesses to deduct the full purchase price of qualifying equipment (including software and hardware) purchased or financed during the tax year. It’s an incentive created by the U.S. Government to encourage businesses to buy equipment and invest in themselves.

Because the allowable Section 179 deduction is expected to be reduced to $25,000 in 2014 and Bonus Depreciation is scheduled to expire, it’s important to plan now to maximize these important benefits in 2013.

Highlights for Tax Benefits:

- The allowable Section 179 deduction has been increased to $500,000 on the cost of new and used equipment purchased through 12/31/2013

- Allows a 50% bonus depreciation of the cost of new equipment [under certain conditions] through 12/31/2013

Section 179 Deduction

For 2013, companies can expense up to $500,000 as a deduction as long as total qualified purchases do not exceed $2.5 million.

- Applies to new and used equipment

- Can be combined with bonus depreciation

- The maximum qualified equipment investment amount that is eligible for the full $500,000 Section 179 deduction in 2013 is $2 million

- Beyond the $2 million maximum equipment investment threshold, there is a dollar for dollar phase-out of the Section 179 Deduction

- Equipment investments exceeding $2.5 million are not eligible for any Section 179 deduction

Bonus Depreciation

The enhanced bonus depreciation benefit allows an additional immediate write-off of 50% of the undepreciated balance for capital expenditures and depreciable property (new equipment only).

- Applies to new equipment only that is placed in use in the United States in the 2013 calendar year

- Equipment must be depreciable under the Modified Accelerated Cost Recovery System (MACRS) and have a depreciation recovery period of 20 years or less

- The Bonus Depreciation benefit is scheduled to expire on 12/31/2013

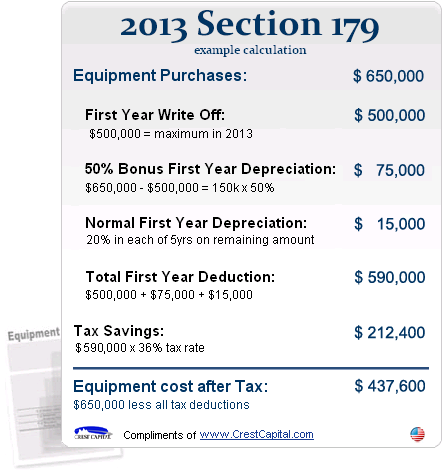

Here is an example of Section 179 at work:

If you’ve been thinking about adding equipment, but just haven’t been able to pull the trigger, contact us today to find out how easy we can make it for you to get the equipment you need and the write-off you deserve.

For more details please visit http://www.section179.org.