Colorado Retail Delivery Fee Avalara-Sage X3

Colorado Retail Delivery Fee Avalara-Sage X3

Effective July 1, 2022, Colorado imposed a retail delivery fee on deliveries made by motor vehicle to locations in Colorado. The fee applies to all deliveries with at least one item of tangible personal property subject to state sales or use tax. The retailer or marketplace facilitator that collects the sales or use tax on the tangible personal property sold and delivered, including delivery by a third party, is liable to collect and remit the retail delivery fee.

In this blog post, we will explain how to set up a Colorado Retail Delivery Fee calculation with Avalara for Sage X3.

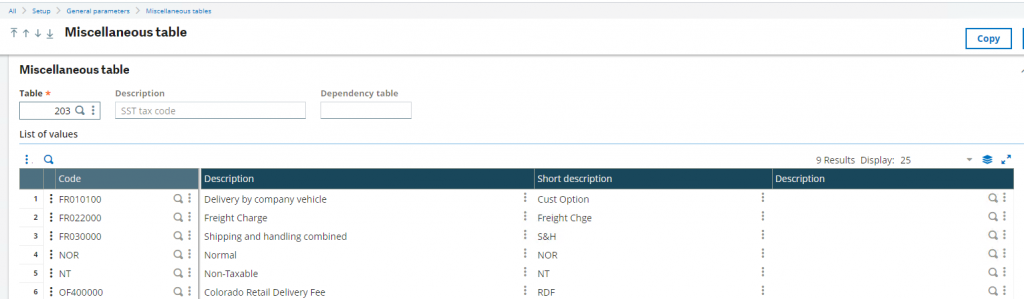

Setup Miscellaneous Table 203

- Go to Setup > General Parameters > Miscellaneous tables

- Search for table 203 in the left list

- Add Code OF400000 and description

- Save

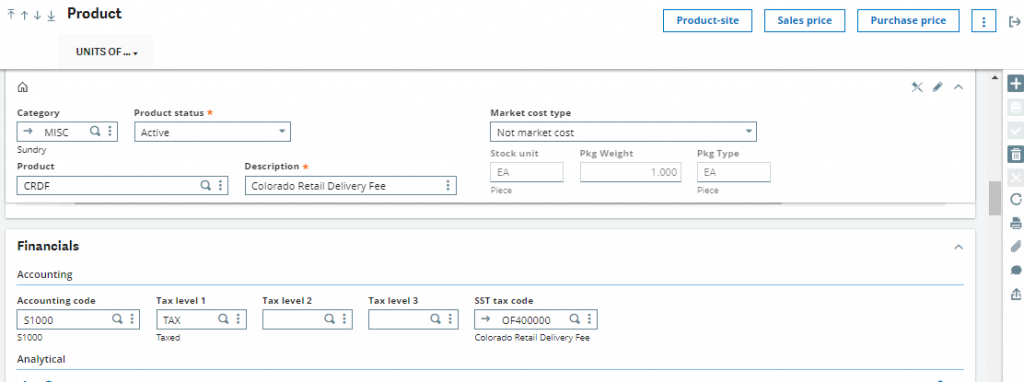

Non-Stock Product Setup

Set up a non-stock product for this fee, with the OF40000 tax code:

- Navigate to Common Data > Products > Products

- Press New

- Select category for non-stock product

- Enter Product code (optional if product sequence exists)

- Enter Description

- Stock Management set to No Management

- Scroll to Financials

- Enter Accounting code

- Select Tax level 1 applicable

- Enter the SST tax code (OF400000)

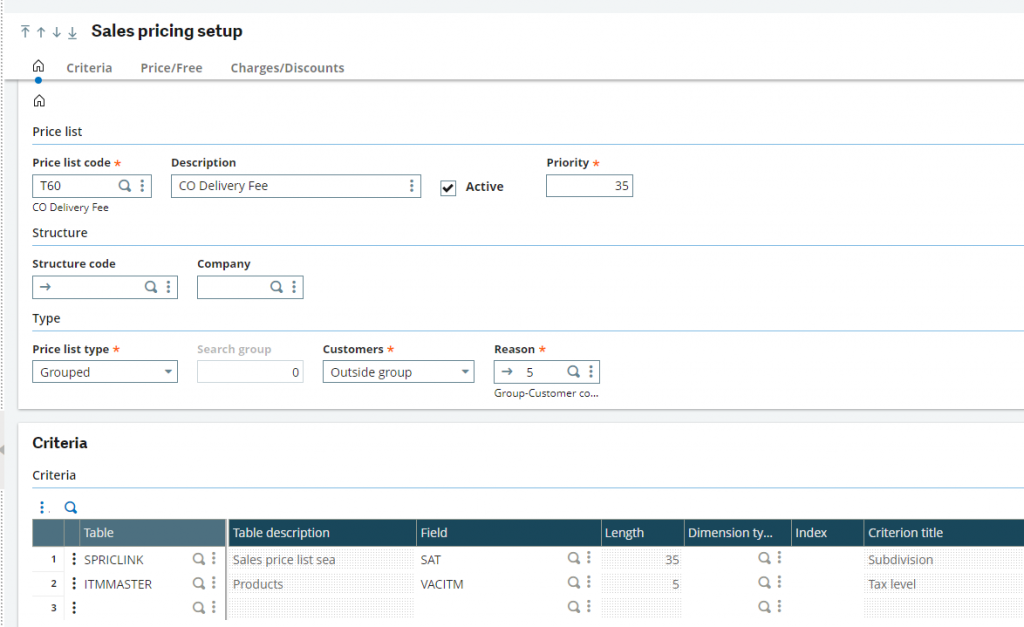

Sales Price List Setup

To allow automatic insertion of the Colorado Delivery Fee product on the sales order lines we will set up a price list with free product on the match of State. Additional conditions can be applied based on the company’s needs.

- Navigate to Setup > Sales > Price List > Setup

- Press New

- Enter T60 or any other code desired

- Set CO Delivery Fee as description and check active

- Set priority to 35 (or other as needed)

- Under Price list type select grouped

- Under Customers select Outside group

- Under reason select 5

- Enter criteria as follows on the screenshot below

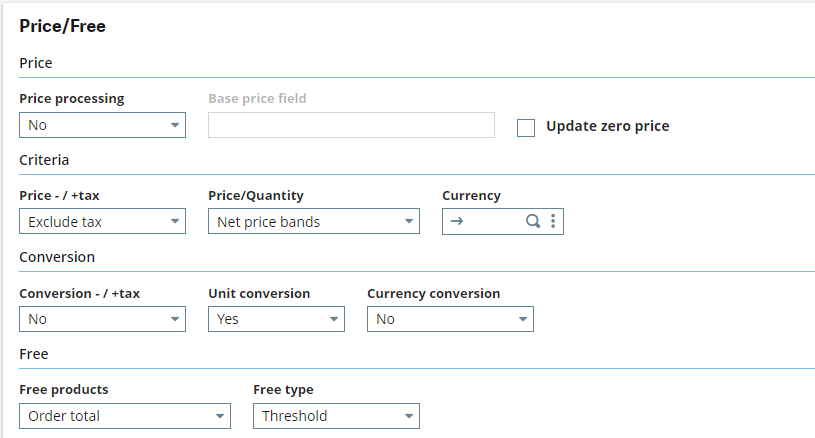

- Click into the Price/Free tab under Sales Pricing Setup

- Under Price Processing select no

- Price – / + tax select exclude and under Price/Quantity select Net Price bands

- Under conversion – / + tax select no, under Unit conversion select Yes, under Currency conversion select No

- Under Free products select the Order total option, select Threshold under Free type

- Create and validate

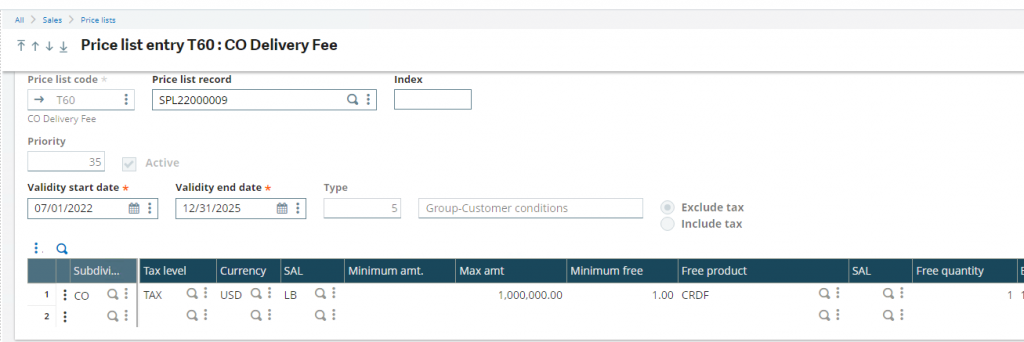

Create a Sales Price list

- Navigate to Sales > Price list > Price list entry

- Select price list entry T60: CO Delivery Fee

- Press New +

- Set Subdivision (State) to CO in the table below

- For Tax level select the TAX (this will depend on the tax setup of the company)

- Set currency to USD

- Set SAL to EA (same as the Colorado Fee Product created)

- Set Max amt to 1,000,000

- Set Minimum free to 1.00

- Enter code CORDF (Colorado Fee Product created) under Free product

- Create

Price List:

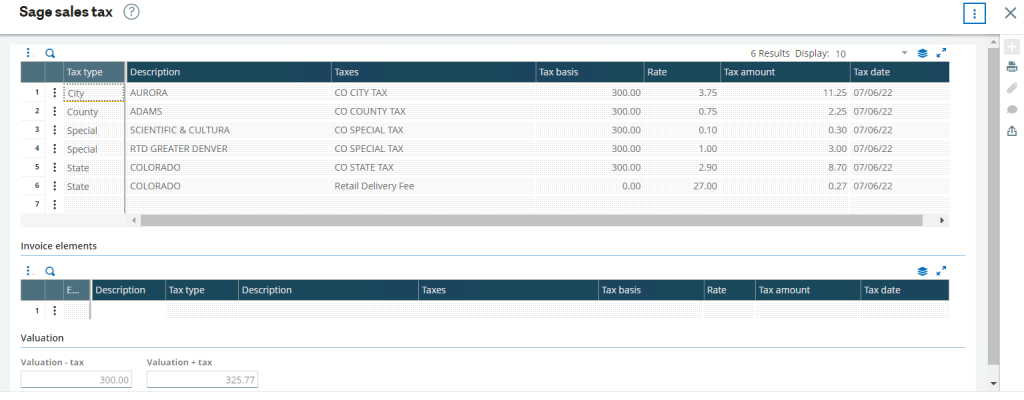

When entering a sales order Sage X3 automatically adds the Colorado Retail Delivery Fee product to any order shipping to Colorado state and Avalara calculates the Retail Delivery Fee accordingly.

If you have additional questions about how to set up the Colorado Delivery Fee calculation, please contact us.

For more information about the Retail Delivery Fee, please visit the Colorado Department of Revenue.