How to Avoid Calculating Taxes When Using Sage X3 and Sage Sales Tax

How to Avoid Calculating Taxes When Using Sage X3 and Sage Sales Tax

There are two ways to avoid calculating taxes when using SAGE X3 and Sage Sales Tax (Avatax from Avalara) as the 3rd party Tax Calculator.

AVOID CALCULATING TAXES FOR ANY TRANSACTION

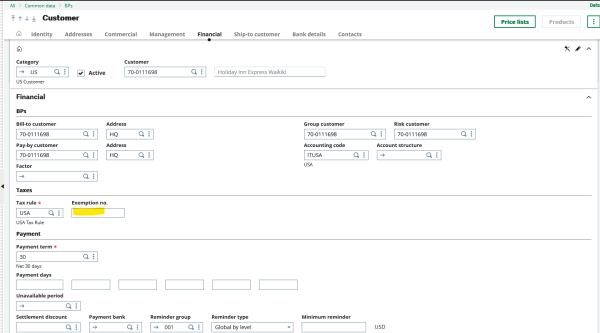

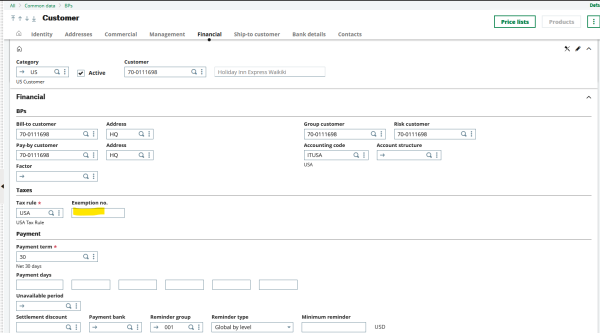

The first way avoids calculating taxes on ANY transaction from a customer. To do this using Sage Sales Tax, simply enter a value—any value—in the Exemption no. field:

Typically, tax-exempt entities recognized by the IRS (for example, religious organization, charities, resellers or similar) enter their tax exempt number in this field. However, entering ANY value in this field will force Sage Sales to avoid calculating taxes for this customer for any transaction. Should you need to calculate taxes on a single invoice, you cannot do it when this field is populated—you will have to clear it first.

AVOID CALCULATING TAXES FOR A SINGLE TRANSACTION

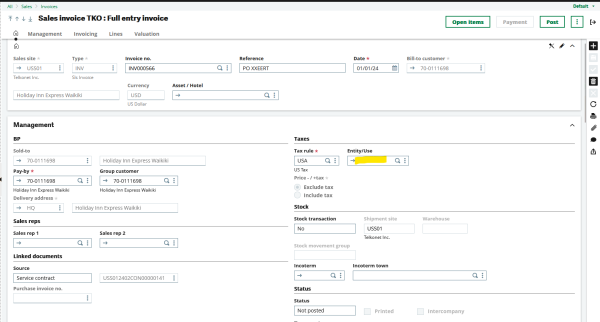

There can be situations where a customer who is usually taxed needs to avoid calculating taxes for a single transaction. In these cases, there is a field in the invoice generation labeled Entity/Use that handles the exception on an individual transaction basis.

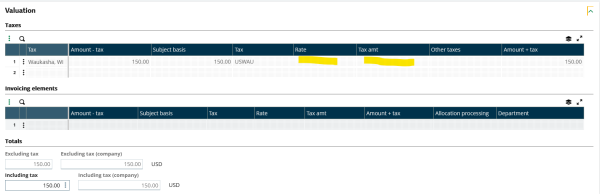

Normally, because this customer DOES NOT have an exemption number associated, the main tax rule will send the information to Sage Sales Tax and will return the value depending of the configurations (Product taxation and jurisdictional sales rates):

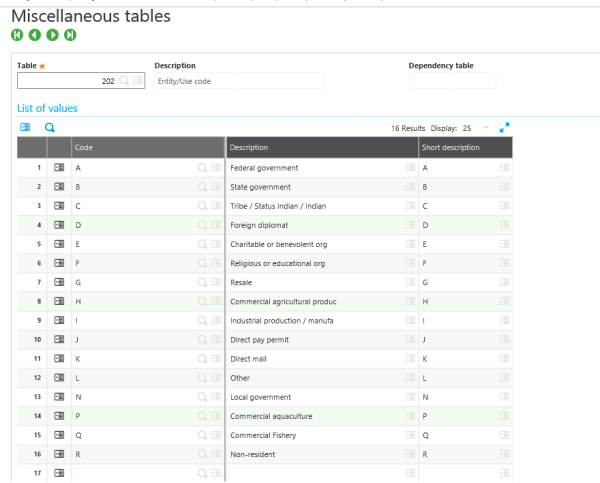

However, if we enter an exemption value in the Entity/Use field, the system will determine if the tax exemption is valid on the transaction’s jurisdiction and will consequently apply it in the calculation. Below is a list of the regular Entity/Use codes. This list is maintained in Common Data / Miscellaneous Tables:

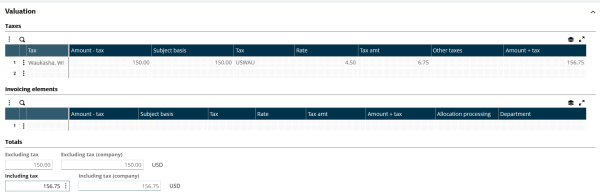

By entering one of these values in the Entity/Use field, the tax calculation will include it and consequently it will make that single transaction exempt:

Note that the Rate and Tax Amount fields now are empty:

This exemption will apply only to this single invoice. Any subsequent transactions for this customer will not take that code into consideration, but instead will revert to the customer’s main configuration (the tax condition that we setup originally for the customer). In this example, the next transactions will be taxable since there is no value stored in the Exemption no. field for this customer.

For more information on how to avoid calculating taxes when using Sage X3 and Sages Sales Tax, or for any other Sage X3 question, please contact us.