Trade Promotion Management for Sage X3

Trade promotion management (TPM) is a set of processes and tools that allow a company to manage trade promotions. A trade promotion is a marketing campaign directed at wholesalers and/or retailers instead of to the end users of a product or service. For example, a wholesaler/retailer may receive a special price or discount for a product or product group for a specific period in addition to allowances they may have already negotiated.

In this blog, we’ll discuss:

- The general features, functions, and processes a customer needs to successfully manage trade promotions

- TPM for Sage X3 using a third party solution

- TPM for Sage X3 without a third party solution

Features, Functions, and Processes to Successfully Manage Trade Promotions

Volume Forecasting

Defines what kind of lift in the normal run rate of a product or group of products is expected due to a promotion.

Financial Forecasting

Defines the financial impact that’s expected due to a promotion.

Trade Spending Budget

Defines a budget for trade promotions and then applies promotions against the budget to ensure that the organization is working within set boundaries.

Deduction Process

Ensures that the promotion parameters are captured, reviewed, approved, and implemented so the business system can properly invoice a customer and ensure proper revenue recognition.

Settlement Process

This process is a reconciliation of what the customer paid for versus what they were entitled to based on the promotion. A customer won’t pay what they’re invoiced if they’ve negotiated allowances. The settlement process may include capturing the payment and having a review/approval process that allows a customer to argue when they disagree with the allowances taken.

Integrating Sage X3 and a third-party TPM solution

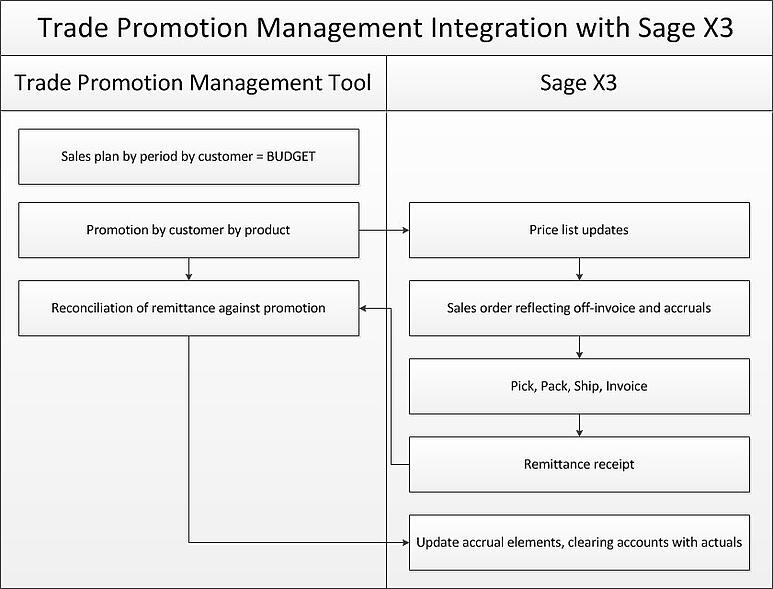

Any third-party TPM system needs product, customer, customer–product, and SKU net activity information. The TPM solution also needs information about payments received to manage the reconciliation process. For Sage X3, we need to capture information about promotions to properly create a sales order that considers all the applicable off-invoice and deductions. Sage X3 also needs information about the reconciliation process to properly update payment receipts to adjust accrual accounts and deduction clearing accounts.

Choosing Sage X3 to manage master file information allows the integration of this type of information to be one way. When integrating systems, it’s best to define one system as the master to avoid bilateral information exchange and avoid the need for synchronization between systems.

Sage X3 can also be personalized to allow for storage of the master file information the TPM tool needs and to hold the combinations of necessary information. Because some promotions aren’t product-specific but rather product-family driven, a statistical group can be used to hold the promo group that a particular product belongs to. This information can be sent to the TPM while the product-customer information is held in the product record in the customer tab. You can expand the number of customers available from 99 to 200, and create several GL accounts to properly account for the different off-invoice and allowances you have.

The overall process looks something like this:

There are other types of promotions the TPM system can handle. For example, one promotion could lead to sending a check to a customer; we could have this promotion type create an AP invoice to cut a check. Another promotion results in a credit memo being issued to the customer; in that case, we could create an AR credit memo for the customer.

Trade Promotions Using Sage X3 Without Third-Party Solutions

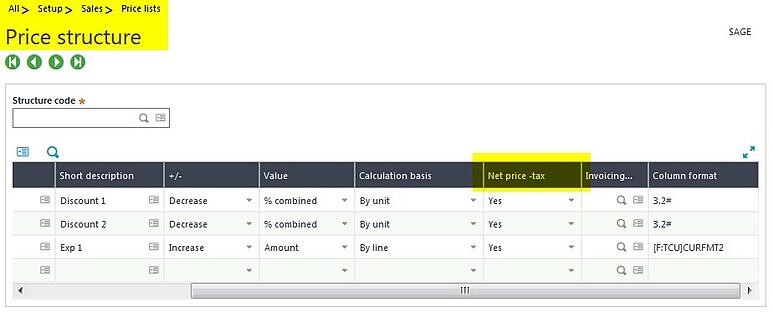

Sage X3’s flexibility allows you to use price lists and the automatic journals to capture pertinent TPM information. The price lists are used to hold by line what the off-invoice or accrual values need to be, while the automatic journals hit specific GL accounts for each of the off-invoice or accrual values.

The first configuration to consider is the sales price list. On that price list, you can configure different discounts and expenses; the key is to identify which element is off-invoice and which element is for accrual purposes.

To do this, go to Setup > Sales > Price lists > Price structure. When the [Net price -tax] field is set to “Yes,” it will be used to determine the final value of the invoice. When set to “No,” a calculation that can be used by an automatic journal is done and stored with the document.

The next configuration is modifying the automatic journal; there are typically two modifications you’ll make. First, you’ll change the way the invoice posts, which involves adding the various elements of the trade promotion. (Charges and discounts have their own GL accounts that affect the sales amount.)

There are also allowances that need to be accrued at invoicing time, since you won’t yet know what the true value will be. You’ll agree on those discounts during negotiations with the customer and they’ll be part of either an annual agreement or a specific trade promotion.

When the payment comes in and it’s time to reconcile what the customer is reporting, you use the payment attributes to ‘true up’ the estimated discounts you thought would be claimed. Any variance can be sent to a separate GL account.

Now that you’ve linked the actual off-invoice amount and, more importantly, the accruals, accounting can compare payments against invoices and actual deductions taken versus those accrued.

Questions about trade promotion management or Sage X3? Please contact us for more information.