What’s New in Sage X3 Finance

What’s New in Sage X3 Finance

In this blog post, we’ll take a look at what’s new in Sage X3 Finance with the release of 2021R3 (V12P27) last month—including the latest changes to existing functionality.

Note: Content for this blog post was originally posted on Sage City by Irfan Chaudhary, September 3, 2021.

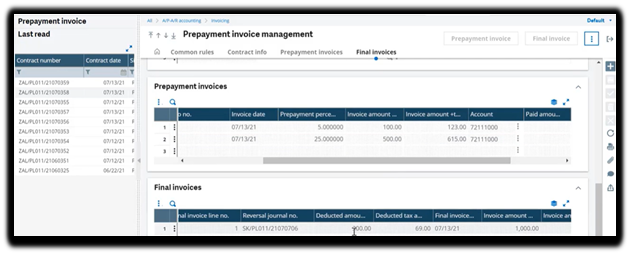

Back in 2021R2 (V12P26), the prepayment invoice management function (GESPREPI) was added under the A/P-A/R accounting module, on the Invoicing sub-menu. This allowed users to create, post and pay prepayment invoices by setting up customer contract data, with relative amounts and specific invoice types for prepayments and final invoices. The invoices were created in the Customer BP invoice function (GESBIC). Dedicated automatic journals are used when posting the prepayment invoices, linked to a contract, as well as transferring amounts from prepayments to the final invoice.

Fast forward 3 months to 2021R3, where there have been further developments to this function; you can now create, manage, and post prepayments invoices linked to a sales order using GESPREPI. Using a standard sales invoice, you can link the invoice to the prepayment management function by setting the PREFUN parameter (TC chapter > INV group) to prepayment invoices for the site. Note, there can only be one contract for each sales order line. Payments are posted to an automatic journal until the contract is settled. The final invoice is a standard sales invoice and when it is posted, the prepayment amounts are reversed so that the open items are settled. This closes the prepayment contract.

Other new features include the new parameter CTLCLOPER located in the CPT chapter, under the CLO group. This is the period closing balance control parameter which will be set to No by default. However if set to Yes, balance controls are performed when closing one or a group of periods.

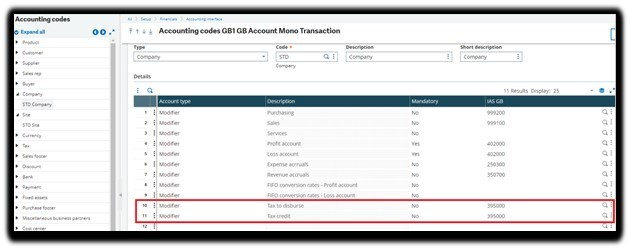

There have also been improvements made to the VAT framework. As per the image below, there are new pre-settings included on the accounting code for company on lines 10 and 11, this will determine the account to be used at the company level.

Similarly, lines 18 and 19 in the accounting code for site have been added to determine the account to be used at the site level.

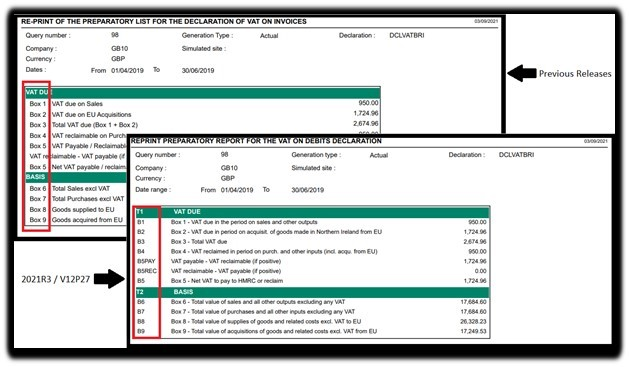

Another new feature for to the VAT framework is the addition of the VAT box code, in the summary section of the VAT report, when printing the following reports from the VAT return function; DCLVATBOXDEB1, DCLVATBOXDEB2, DCLVATBOXPAY1 and DCLVATBOXPAY2.

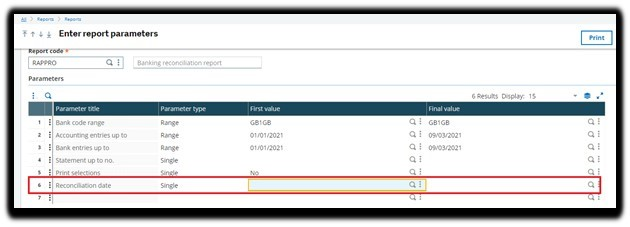

There has also been a development to the bank reconciliation report, whereby a new parameter for reconciliation date has been added to allow users to search for entry lines that have or have not been reconciled as of the reconciliation date.

If the parameter is left blank, the report will only include non-reconciled bank/accounting entry lines within the date range. However when a reconciliation date is entered, the report prints every entry line within the date range that is not reconciled as of the reconciliation date.

For more information on these new features and others, please review the release notes or further training on how to use the features, check out the What’s New in Patch 27 training material on Sage University.